Why it’s important to protect your wine and spirits

Wine has become a top collectible

While many luxury items continue to attract successful families and individuals, wine has become a top collectible. In the last year, worldwide wine sales from in-person and online auctions were solid, increasing 9% to $521 million, with the U.S. market leading sales with approximately $225 million. Red burgundy continued to be one of the best sellers, with a magnum of DRC Romanée-Conti 1991 going for $51,870 at Zachys Wine Auctions and topping the previous world record by over $10,000.1

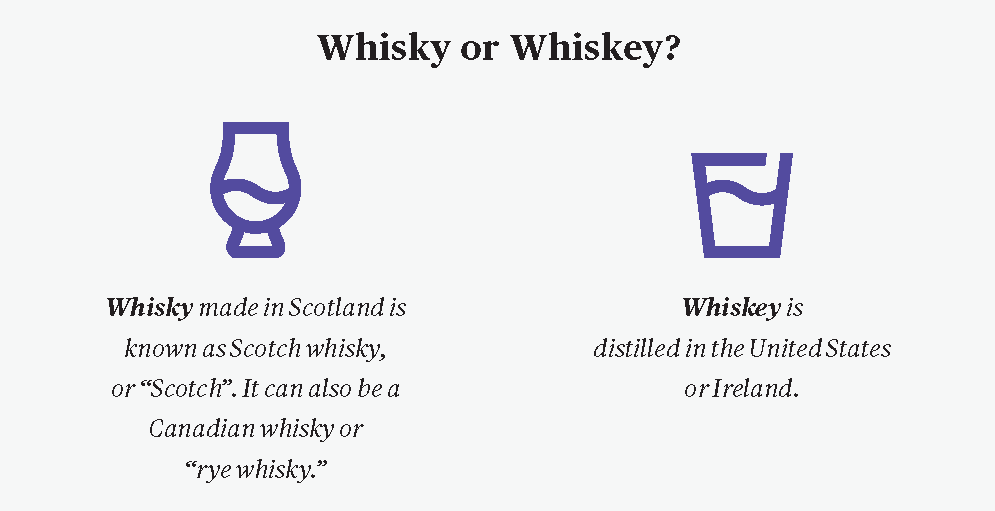

More people are collecting spirits

Another trend to watch is the collection of spirits, or hard alcohol. Spirits such as cognac and whisky are gaining in popularity. In fact, the top-selling alcohol lot of 2019 was not wine but whisky. A bottle of The Macallan Fine & Rare 60-year-old 1926 set an auction record for any wine or spirit, selling for $1.9 million at Sotheby’s London, well over its presale high estimate of $550,000.1

Only a portion of wine and spirits are insured

While some wine and spirits enthusiasts take pride in making sure their collections are protected in case of damage, spoilage, or loss, a surprising number are still uninsured or underinsured, especially if their collections haven’t been appraised on a regular basis.

4 reasons to look for the right wine and spirits insurer

If you don’t believe you need to protect your wine and spirits with insurance, here are a few reasons to reconsider:

Your homeowner’s policy may not cover your wine and spirits.

You may think that your homeowner’s insurance policy will cover you if your wine and/or spirits spoil or are stolen or damaged. But that might not be the case. Typical homeowner’s policies are meant to protect your home, its general contents, and to protect you from personal liability. This can lead to significant out-of-pocket expenses if a wine and spirits collection is damaged. A premium valuable articles policy will cover you with no deductible, provide worldwide coverage, and protect you even if your bottles break or spoil due to temperature changes caused by mechanical breakdown or failure.

Damage often happens while bottles are in transit.

Make sure you have a policy in place that will protect your wine and spirits while they are being transported from the auction or vendor to your home or storage facility. The right insurance company can also provide you with recommendations for transporters who have expertise in handling wine and spirits and will properly pack and ship yours.

You don’t need a current appraisal in all cases.

While it may be helpful to have a high-quality appraisal for your fine wine and spirits, a current appraisal isn’t always necessary with some insurance companies. Some companies won’t require an appraisal unless your individual wine or spirits purchase is valued at over $50,000. They just need a good description of the wine or spirit, including its provenance, condition, date, and an estimated value. They’ll also provide automatic coverage for newly acquired spirits, so you don’t have to worry about getting each new bottle on the policy the same day you buy it.

Protecting your wine and spirits isn’t just about the right insurance.

Getting the right protection to fit your needs is important. But it takes more than a good policy to select the right bottle of wine, whisky, or cognac, keep it safe, and make sure it’s replaced if it is damaged or spoils. The right insurance company will provide the coverage you need and the resources to help protect your investment against loss. For example, Chubb can help you get risk assessments for your cellar or offsite storage facility, use infrared to detect harmful environmental conditions, and help you prepare for and respond to natural and man-made disasters, to keep your collection safe.

Protect your wine and spirits

With the market for wine and spirits continuing to grow, it’s more important than ever to protect your valuables and ensure that they can be replaced if they are stolen, broken, spoiled, or damaged.

Contact a CapriCMW Private Client Services Advisor to learn more about insurance and protection for your private collection.

Thank you to our friends at Chubb for this guide. Download the complete guide here.