Why it’s important to protect your fine and decorative art

The power of the fine and decorative art market

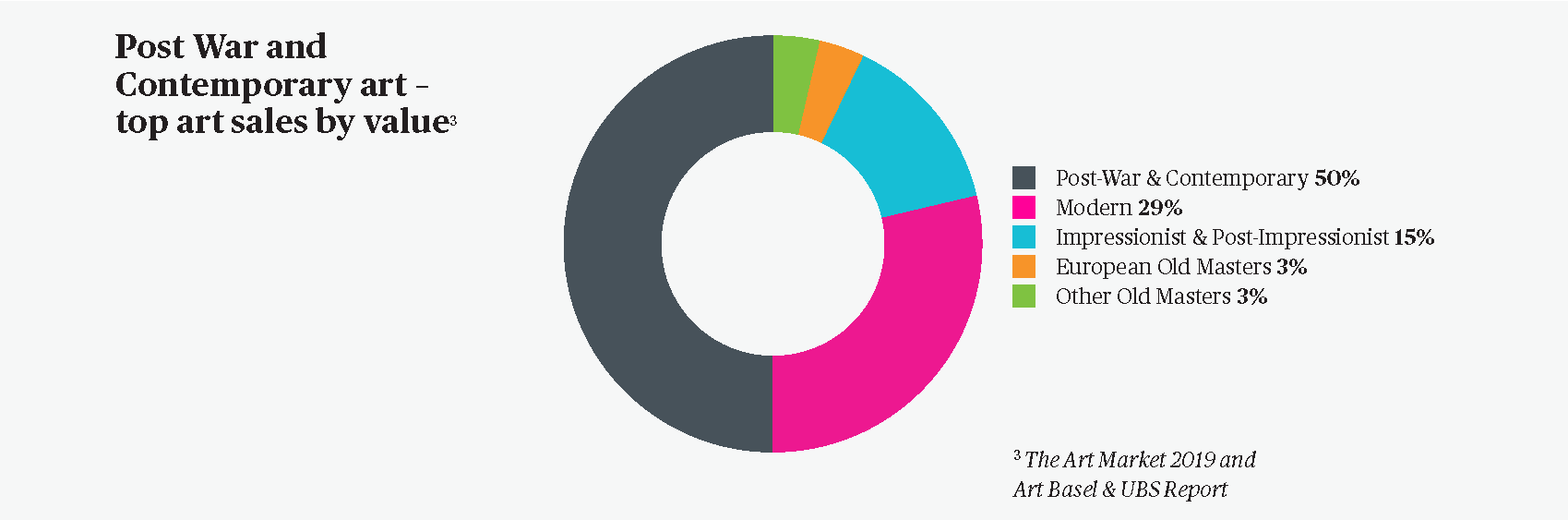

Over the past decade the art market has become truly global, although the United States, China, and the UK still account for the vast majority of sales. As new audiences gain exposure and access to artwork and collectibles of all kinds, sales have trended upwards, with an overall increase in sale totals of over 60%.1 Online sales also continue to increase, with a growing number of collectors turning to digital platforms to acquire artwork. Online sales are particularly strong among millennial collectors.1

Female artists are attracting attention2

While men have overshadowed their female counterparts in the art world for centuries, many women artists are now getting due recognition for their contributions to influential art movements, with major museum retrospectives, gallery shows and rising values. Two top female artists include Yayoi Kusama (born in 1929) and Joan Mitchell (1925-1992). Kusama, a renowned provocative avant-garde artist from Japan, brought in the highest sales at auction in 2018, with a total of $86.4 million. Mitchell, a leading abstract expressionist American painter, was a close second, with sales totaling $83.5 million at auction, and an individual record set of $16,625,000, including buyer’s premium, for her 1969 painting “Blueberry”.

Not all artwork is fully insured

While some art enthusiasts take pride in making sure their collections are protected in case of damage or loss, a surprising number are still uninsured or underinsured, especially if their collections haven’t been appraised on a regular basis.

Sources:

1 The Art Basel and UBS Global Art Market Report 2020

2 “Behind Joan Mitchell’s Market Revival,” MutualArt, August 28, 2018

“Top 10 Female Artists of 2018,” BLOUIN ARTINFO, December 17, 2018

“Records tumble for top female artists and the time-honoured fruits of attractively low estimates,” The Telegraph, May 29, 2018

5 reasons to look for the right art insurer

If you don’t believe you need insurance to protect your fine and decorative art, here are a few reasons to reconsider:

Your homeowner’s policy may not cover your art.

A typical homeowner’s policy is designed primarily to protect your home, personal liability, and the general contents of your home. Relying solely on your homeowner’s policy may mean paying significant out-of-pocket expenses if your artwork is lost, stolen or damaged. Fine art insurance policies provide “all-risk” coverage for most causes of loss, with no deductible. Some insurance companies cover fine and decorative art items valued at less than $250,000 without an appraisal. The insurer just needs a good description of the item as well as the estimated value.

The right policy can provide more than cash for a loss.

Caring for your art collection can be complicated. If you’re not sure how to best do this, you’ll want experts on hand to help. You will want an insurance company that provides a full suite of consultative collection management services to complement their policy, including:

- A collection risk assessment at your home, office, or off-site location

- Guidance on proper storage and display conditions

- Fire protection and security recommendations

- General advice about preserving your collection

- Referrals to art professionals

If your art is lost or stolen, you’ll want to replace it.

Look for a fine and decorative art policy that will cover misplaced, lost, or stolen items. And, if the market value of an itemized article exceeds the amount listed in the policy right before it is lost or stolen, you’ll want an insurance company that will pay the higher market value, up to 150% of the itemized amount, so that you can replace the item with one that is comparable.

If your art is damaged, you’ll want it restored to its original condition.

Many homeowner’s policies exclude coverage for breakage of fragile items, like crystal, china and porcelain. The right insurance policy will automatically cover you for breakage. It will also cover your newly acquired artwork for up to 90 days, for up to 25% of the total itemized fine and decorative art coverage. That way, you don’t have to worry about getting insurance for each item on the day it’s purchased.

You may need to have your artwork transported.

Make sure your items are covered at all times. The majority of fine and decorative art losses occur while items are in transit. Your insurance company should be able to provide referrals to vetted art transporters you can trust.

Protect your fine and decorative art

With the market for fine and decorative art continuing to grow, it’s more important than ever to protect your valuables and ensure that they can be replaced if they are stolen, broken, or damaged.

Contact a CapriCMW Private Client Services Advisor to learn more about insurance and protection for your private collection.

Thank you to our friends at Chubb for this guide. Download the complete guide here.