The co-insurance clause is a common and often misunderstood part of property insurance policies.

In effect, the insurance company agrees to reduce the premium on a policy if you (the property owner) will carry insurance equal to a specific percentage of the property’s true value (usually 80% to 90%). As the property owner, you assume the responsibility of maintaining the required amount of insurance at all times.

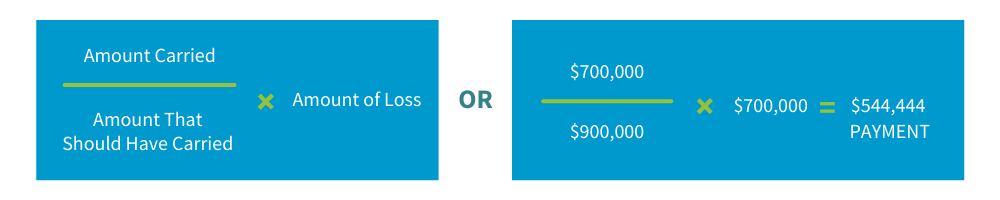

In accepting the reduced rate, you are subject to a penalty if you do not insure up to the percentage specified in the co-insurance clause. In the event of a claim, you become a "co-insurer" and share in the loss by having your payment reduced. The following example offers some clarification:

In a typical 90% co-insurance situation:

If the replacement cost value of the property is $1,000,000, the minimum amount of insurance that must be carried is $900,000. Now, assume you actually carry only $700,000 in insurance and you suffer a loss in that amount:

Since the amount recoverable is only $544,444, you (the “co-insurer”) are responsible for the $155,556 shortfall.

Had you insured up to the required $900,000, no penalty would have applied and you would have recovered your loss in full.

To ensure that proper limits are in place, it is important to get a professional appraisal which will take into consideration all the required elements that a replacement cost policy wording encompasses. Frequent changes in building materials, labour and items such as by-laws or demolition and salvage costs need to be included in the value which the professional appraiser can determine.

For information and resources on insurance and risk management for your business, please contact a CapriCMW Risk Advisor.